As geopolitical tensions underscore energy security and the relentless rise of AI drives soaring electricity demand, nations face a pivotal moment to rise to the challenges. GAM’s European Equities team – Tom O’Hara, Jamie Ross and David Barker - believe this presents unprecedented investment opportunities in areas such as power infrastructure.

01 September 2025

Power supply and energy security have become the most important issues faced by the modern nation state. There are two main issues with overlapping consequences. First, the Russia-Ukraine conflict and the historic (European) dependence on Russian gas have fostered a race towards energy independence. Second, artificial intelligence (AI) is driving a step change in electricity demand. The US is leading the charge on both issues, with their clear priority demonstrated by the following quote from Donald Trump.

My administration is pursuing a future of all-out American energy dominance.

Europe, as is often the case, is following, rather than leading, but we believe power supply and energy security will be the focus of the next few decades, and this brings with it some compelling, long-term investment opportunities.

The need for energy independence

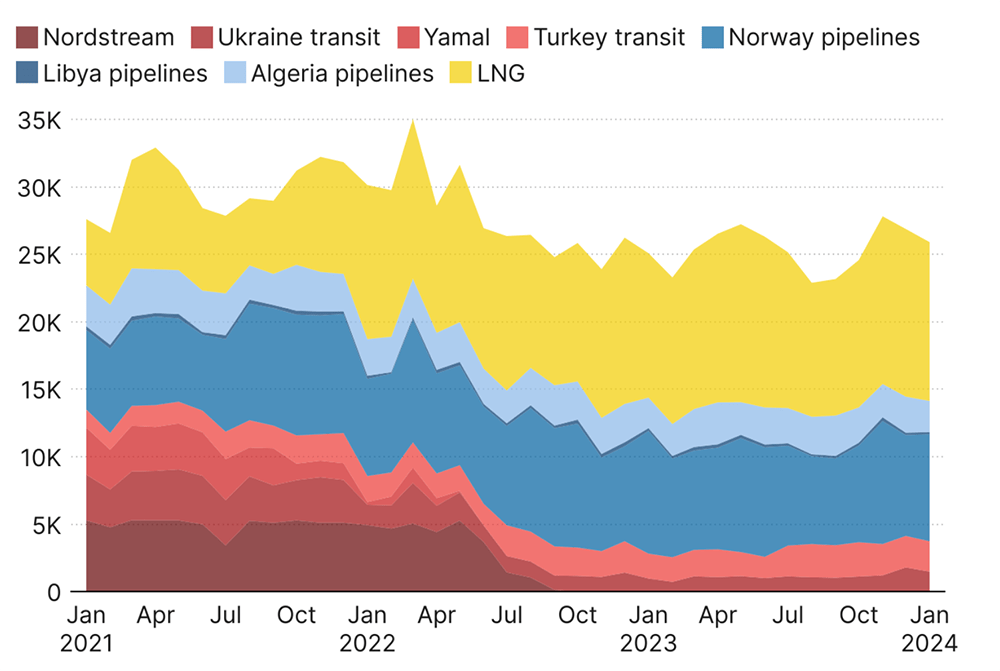

For decades, Europe has been over reliant on Russian natural gas, a relationship shaped by geographical proximity, infrastructure, and commercial considerations. Beginning in the Soviet era and expanding after the Cold War, pipelines such as Nord Stream – a natural gas pipeline through the Baltic Sea – connected Russian gas fields directly to European markets. By the 2010s, Russia supplied roughly 30–40% of the EU’s gas imports2, making it both a vital energy partner and a geopolitical vulnerability. It took the Russia-Ukraine conflict to reveal this catastrophic geopolitical mistake that had been hiding in clear sight.

2022 saw Europe sharply reducing its purchases of Russian gas. In a way, this was a mutual decision with Europe imposing sanctions and Russia cutting supplies into Europe. Europe saw record-high gas prices as a result and fear of shortages. Europe has since focused on securing liquefied natural gas (LNG) from the US, Qatar, and others, reactivated coal plants, expanded renewables, and implemented energy-saving measures. Nevertheless, energy security remains fragile, infrastructure is ageing and, as shown by recent Spanish supply issues, unreliable at times of stress. Further investment is clearly needed.

Natural gas imports to the EU27

Million cubic meters per month

The US’s path toward energy independence has been driven more by its vast natural resources rather than by a specific geopolitical event. Nonetheless, growing unease with China in particular has promoted energy independence to a key national priority under the current administration. For much of the 20th century, the US was a major oil importer, heavily reliant on foreign suppliers, particularly during the oil crises of the 1970s. The turning point came in the early 2000s with the shale revolution – advances in hydraulic fracturing and horizontal drilling unlocked vast reserves of oil and natural gas from previously inaccessible formations. Domestic production surged, reducing import dependence and eventually making the US a net exporter of natural gas in 2017 and of petroleum in 2019. This position of energy independence was hard-won, and, in our view, maintaining this status will remain a US national priority.

The AI arms race

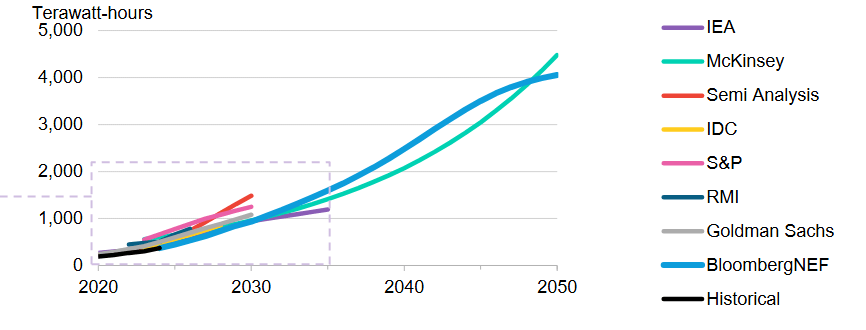

Simultaneous to rising geopolitical tension has come the dramatic and inexorable rise of AI usage. In January, the Trump Administration stated that it is US policy to “sustain and enhance America’s global AI dominance in order to promote human flourishing, economic competitiveness, and national security.”4 And rising AI usage requires significant data centre and infrastructure build-out alongside the resulting ballooning demand for electricity. For context, a single large data centre might consume 100-300 gigawatt-hours (GWh) of electricity on an annual basis; this is equivalent to the electricity usage of an urban area of 60,000 to 180,000 inhabitants. With over 5,700 data centres currently operational and, according to the Financial Times, 8,400 likely to be in use by 2030, this is fast becoming a significant source of growth for electricity demand. Electricity demand in developed countries has been largely stable for decades, but the Energy Information Administration (EIA) now expects significant growth over the next few decades. Strategic research provider BloombergNEF estimate that data centres consumed 371 terawatt-hours (TWh) of electricity in 2024, accounting for 1.4% of global electricity consumption5. Long-term forecasts are extremely difficult, but McKinsey estimate that data centre consumption will expand by over 12 x by 2050 to reach 4,480TWh6, a level equal to 17% of current global electricity demand. The implications are clear; huge investment is needed across the world to meet the growing demands of AI on a creaking energy infrastructure system.

Data center electricity consumption

Terawatt-hours

Where will investment be needed?

Building a data centre requires both direct and supporting infrastructure. Direct needs include land and construction materials (typically 30-40% of the total cost), IT and networking equipment (servers, cabling and other hardware; typically 40-50% of the total cost) and power and cooling infrastructure (typically 20-30% of total cost)7. Supporting infrastructure needs are more focused on electricity generation and grid capacity, cooling and water management and network infrastructure.

Focusing in on electricity and grid capacity, there are a number of areas that will require heavy investment.

- Electricity generation. A balanced generation mix is the primary target. Heavy renewable energy investments will be required, especially to help companies meet sustainability targets. Natural gas plants are another growing area of focus. The next decade will also bring significant advantages in Small Modular Reactor (SMR) technology. Battery storage will be essential.

- Grid. Ageing infrastructure requires significant investment to make it capable of handling the demands of a data centre-led world. Substations need to be upgraded, high-voltage transmission lines laid down and general network expansion and replacement is essential.

- Onsite energy infrastructure. This is an underappreciated area. On-site battery storage, back-up generation (shifting to natural gas turbines) and systems that shield the datacentre from periods of grid instability.

What stocks and sectors are set to benefit and how are we positioned?

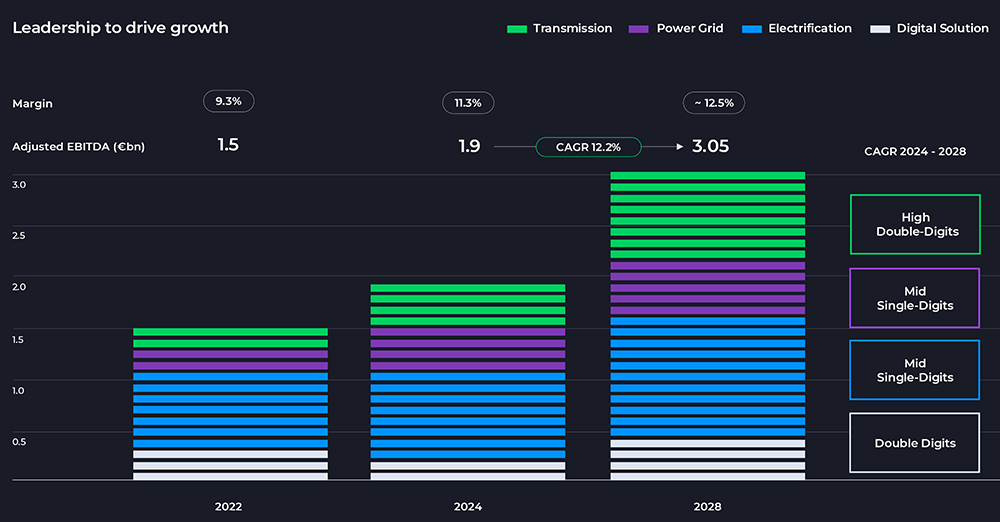

Over a third of our portfolios is directly exposed to the themes discussed in this article. We are invested in data centre construction via CRH (concrete) and Infineon/ASMI (semiconductors). We have exposure to grid infrastructure build-out via positions in SSE (grid), Prysmian (cables) and Siemens (electrical equipment). Our holding in Siemens Energy (gas turbines, wind turbines and small modular reactors) gives us a play on onsite energy infrastructure.

In summary, we view 'Power surge' as a key investment theme that will drive market direction globally and within Europe itself. It is our largest thematic exposure and one to which we have established a diverse, multi-sector exposure. We are believers in (and heavy users of) AI and acknowledge that the geopolitical environment is forcing investment decisions that will unfold over decades rather than years. We want to be heavily exposed to the companies that are set to benefit.

Tom O’Hara, Jamie Ross and David Barker manage European Equities strategies at GAM Investments. You can find out more information on the team and the strategies they are responsible for here.

As at 31 July 2025, CRH, Infineon Technologies, ASM International, SSE, Prysmian, Siemens and Siemens Energy were held within the strategies managed by the team.