Kevin Moss, President and Portfolio Manager at Liberty Street Advisors (LSA), Inc., sees private equity, and specifically late-stage venture capital, as a high-potential opportunity for investors seeking long-term growth, especially in a market where companies are staying private longer and scaling rapidly before reaching public markets.

31 July 2025

Private markets have changed dramatically over the past two decades, and so has the way we access them. I began my career in public equities before moving into private equity, ultimately into the strategy I manage today: late-stage venture capital (VC). It is a space I have focused on for over a third of my career.

Our Private Shares strategy is designed to give investors access to high-growth, late-stage private companies, businesses well beyond the startup phase, generating meaningful revenue, and backed by sophisticated institutional investors. In a different era, many of these companies would already be public. Today, they are choosing to stay private longer, and that is where we see opportunity.

Why private markets, and why now?

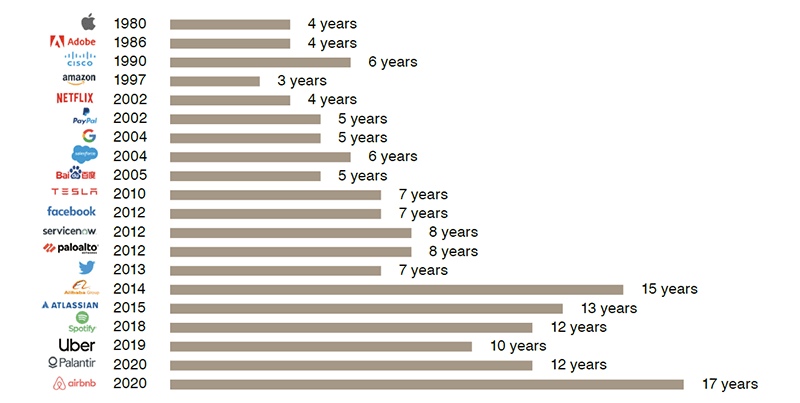

Chart 1: Tech Companies from Founding to IPO (IPO year)

We are witnessing a fundamental shift in capital markets. Companies are staying private longer, for an average of 12 years, and in some cases up to 20.1 As a result, much of the innovation and value creation that once occurred in public markets now happens behind closed doors. This structural shift is reshaping the investment landscape. Today, over 75% of US companies generating more than USD 100 million in revenue are privately held.2 Many of these firms are driving innovation in sectors such as artificial intelligence (AI), cybersecurity, fintech and healthcare technology, while still in private hands.

For investors, relying solely on public markets could mean missing out on some of the most compelling growth opportunities of the next decade, in our view. This presents both a challenge and an opportunity for investors: how do you access these companies before they go public, or in some cases, instead of going public at all?

That is where our strategy comes in. We aim to bridge this gap, offering access to a diversified portfolio of late-stage private companies with proven business models, strong management teams and clear paths to liquidity. These businesses are often backed by top-tier institutional investors and are generating meaningful revenue, well beyond the startup phase.

A milestone moment: Voyager Technologies

A major milestone came on 11 June 2025, when Voyager Technologies, a US space technology company specialising in national security and space solutions, successfully debuted on the New York Stock Exchange (NYSE) under the ticker VOYG. The initial public offering (IPO) raised USD 382.8 million, with shares more than doubling on the first day of trading, valuing the company at USD 3.8 billion.3 Our cost was USD 29.21, they priced the IPO at USD 31 and it opened at USD 69.75 closing at USD 56.48.4

This was a good example of how our investments should work, and the first of many anticipated exits for our strategy. It validates our approach: backing innovative companies in their final private funding rounds.

Best investment and toughest loss

We are proud of all our investments, while each has its own story. However, one standout is Marqeta, a payments company. We first invested at around USD 2 per share. During Covid, valuations surged and Marqeta climbed to USD 13, then USD 40. We exited in stages, ultimately selling the final tranche post-IPO in the mid-20s. A strong return and a great example of disciplined execution.

Our most challenging investment in this strategy was Sungevity, a solar company. In 2016, fears of a regulatory crackdown on clean tech led to credit lines drying up, which was critical for capital-intensive solar firms. Sungevity, like many peers, went bankrupt. It was a meaningful position and a tough loss. Lesson learned is to avoid capital-intensive businesses that rely heavily on external credit. High cash burn and financing risk can be a dangerous mix.

How we source deals

One of the most common questions we get is: How do we find these opportunities? The answer is simple; relationships. Over the years, we have built a trusted network of entrepreneurs, venture capitalists, private equity firms and tech insiders. We are also highly selective. We avoid binary sectors; those with uncertain outcomes or heavy regulatory risk, and instead focus on companies with strong fundamentals and credible investor syndicates. The investable universe is robust and has a strong pipeline, with around USD 10 billion in deal flow annually.

We source deals through both primary and secondary transactions. On the primary side, we are invited into rounds by our VC partners and portfolio companies – currently 85 and growing. We also maintain strong relationships with bankers at firms like Goldman Sachs, Morgan Stanley and JP Morgan, who bring us into capital raises. On the secondary side, we work closely with brokers who know we specialise in private transactions, providing us with a steady stream of opportunities throughout the year.

Our edge

We are sector-agnostic by design. We believe technologies transcend traditional industry boundaries, so we focus on innovative companies that are disrupting their respective sectors. Diversification is a core principle for us. We aim for breadth across portfolio companies, typically spanning 15 to 20 sectors. We deploy capital continuously, building exposure across different market cycles and vintages.

Our evergreen structure also gives us what we think is a distinct advantage. Unlike traditional private equity vehicles, our model allows for continuous capital deployment and quarterly liquidity, making private markets more accessible and aligned with today’s investor needs.

Looking ahead

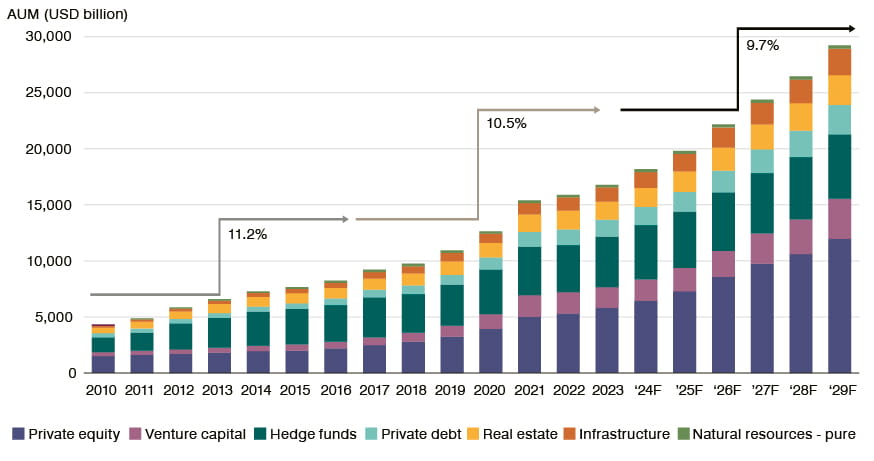

Chart 2: Global alternatives’ AUM and its growth rates by time periods

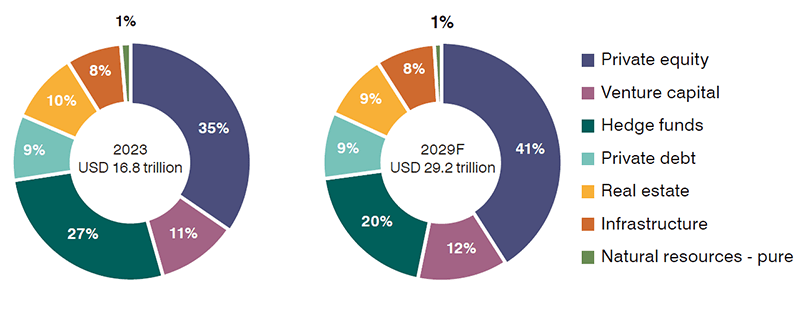

Chart 3: Private equity share to grow from 35% in 2023 to 41% in 2029F

Alternatives’ AUM to nearly double from USD 16.8 trillion between 2023 and 2029

Note: “F” denotes forecast. 2029F refers to the projected value for the year 2029.

Despite a sometimes challenging macro backdrop, we believe demand for alternative investments remains strong. According to Preqin, assets under management (AUM) in alternatives is expected to nearly double from USD 16.8 trillion between 2023 and 2029. During this period, private equity’s share of overall alternatives AUM is projected to grow from 35% to 41%, approaching USD 12 trillion by 2029. We believe this growth reflects a broader shift in investor preferences towards strategies that offer differentiated access to innovation, resilience through market cycles and long-term value creation.

Liquidity trends are also encouraging. In Q1 2025, venture capital exit activity reached its highest level since Q4 2021, with USD 52.6 billion generated across 385 exits.5 While tariff-related uncertainty may delay some listings in the short term, we expect corporate M&A and private equity-led buyouts to remain active throughout 2025. At the same time, we are seeing one of the most compelling IPO backlogs in recent history, featuring high-performing technology and innovation companies with strong growth and profitability. As volatility subsides, we anticipate a pickup in public market offerings in the quarters ahead.

Final thoughts

Private markets are no longer a niche; they are a necessity in our view. As more companies choose to stay private longer, the ability to access them before they exit becomes a critical part of portfolio construction. At Liberty Street Advisors, we are proud to partner with GAM to bring this opportunity to investors in Asia, Australia, Europe and beyond.

The journey is just beginning, and we are excited for what lies ahead.

Kevin Moss, Managing Director of Liberty Street Advisors, Inc., manages the Private Shares strategy for GAM Investments.

You can find out more about Liberty Street Advisors, private markets and late-stage venture capital opportunities here.

DISCLOSURE: Certain companies mentioned are current or former investment positions. Current holding includes Voyager Technologies; former holdings include Marqeta and Sungevity.

2Source: Pitchbook, as at 6 Jan 2025.

3Source: Reuters, 11 June 2025.

4Source: Bloomberg, 11 June 2025.

5Source: National Venture Capital Association (NVCA), PitchBook, PitchBook-NVCA Venture Monitor, as at March 31, 2025.