Our Hyper Active series explores how GAM Investments’ portfolio managers – across both equities and fixed income - aim to harness the potential of active management to deliver better results for clients. In the latest edition, we spotlight Niall Gallagher, Investment Director, European Equities.

13 September 2024

While passive investment has grown in popularity over recent years, with cost-conscious investors opting to track rather than potentially outperform market indices, we now face a new age of uncertainty. Geopolitics shifts and rapid technological advancement - from automation to AI – are impacting every industry and shaping our future. For investors, the opportunity to pick the stock winners from the losers could be more rewarding than ever.

The first article of our Hyper Active series, "Why active investment strategies can leave passive approaches lagging", drew on our expertise as an active house and featured Flavio Cereda, Investment Manager, Luxury Equities. Flavio discussed active management in the luxury sector, including how his approach could potentially exploit stock performance dispersion. In the coming weeks, we will feature other GAM portfolio managers, and this week, Niall Gallagher explains how he uses active management to target stock-specific risk in European equities.

Targeting stock-specific risk among Europe’s global winners

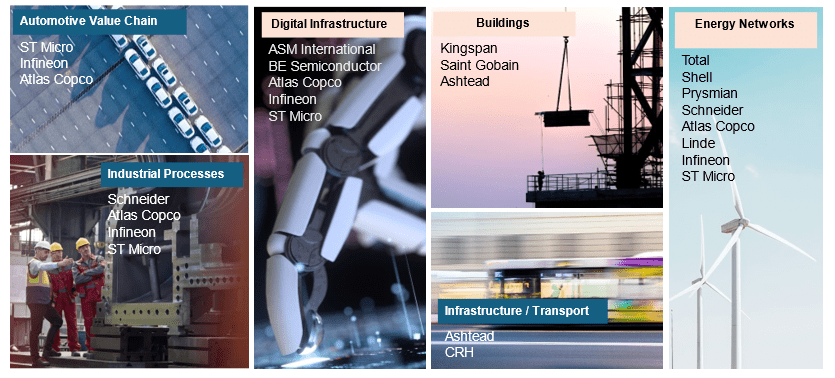

Our goal is to identify and maximise stock-specific risk that simply cannot be replicated by smart beta / factor exchange traded funds (ETFs) [which blend active and passive investing following an index but also consider alternative factors in choosing stocks from the index], let alone generalist European index-based passive funds. Through active management of portfolios, we seek to maximise idiosyncratic alpha in a way that is consistent with our fundamental research process, with the following themes defining what we view as a new investment era:

- Return to normal interest rates and yields

Interest rates and bond yields were abnormally low for an extended period. While the normalisation may challenge newer business models based on the assumption of zero rates in perpetuity, we believe it has been transformational to bank sector earnings and Return on Capital Employed: we have held key overweights, for example, in UniCredit and CaixaBank. - Decarbonisation and the capex supercycle

In our view, existing cash-generative energy sector heavyweights with deployable capital and technical expertise have a major role to play in the hugely ambitious net zero drive, while the scale of required new infrastructure investment has also been underestimated: we favour companies such as TotalEnergies. - Digital transformation

There are multiple facets to the global change, from automation, semiconductors, cloud computing, AI and the wider offline-to-online switch: Europe has global enablers and regional champions. ASM International is a good example. - Rise of the Asian middle class

By 2030 there will be around one billion new middle-class consumers globally, according to some estimates, with Asia accounting for two-thirds of global consumption. Europe-listed companies dominate high-value consumer sectors – we favour LVMH and Inditex. - Era of higher resource prices

Resource sectors, especially energy, have seen a major drop in capex over the last decade, with supply growth falling. Beyond energy, mining investment is insufficient to meet the needs of the net zero push. Our key overweights include Linde.

Our European active management edge: focusing on our highest -conviction stock selections within structural themes.

The views are those of the manager and are subject to change. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Allocations and holdings are subject to change.

An active strategy also gives us the tools to express our thematic views far more effectively than using a blend of thematic ETFs. For example, while we like European industrials, rather than hold a basket of all 95 or so industrials in the MSCI Europe index in the way a sector ETF would, we instead concentrate on the stocks we like most, such as Saint Gobain. Conversely, while we may be unimpressed by the earnings growth outlook in healthcare generally, as active managers we can still take an overweight position in individual stocks that stand apart from the sector, such as Novo Nordisk, while unweighting the sector as a whole. In summary, active management gives us scope to add multiple potential drivers of long-term fund performance.

Niall Gallagher manages the European and Continental European Equity strategies at GAM Investments

Stay tuned for the next edition of our Hyper Active series to learn more about the philosophy behind active management and how GAM Investments’ portfolio managers put the approach to work for our clients.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Investors could lose some or all of their investments.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in indices which do not reflect the deduction of the investment manager’s fees or other trading expenses. Such indices are provided for illustrative purposes only. Indices are unmanaged and do not incur management fees, transaction costs or other expenses associated with an investment strategy. Therefore, comparisons to indices have limitations. There can be no assurance that a portfolio will match or outperform any particular index or benchmark.

The foregoing views contains forward-looking statements relating to the objectives, opportunities, and the future performance of the markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.