China is leading the way in both electric vehicle (EV) manufacturing and consumption, with China’s domestic market accounting for 62% of global EV sales in 2022. GAM Investments’ Wendy Chen highlights how China is reshaping the EV landscape in terms of user experience, extended battery life and affordability.

10 August 2023

Click here to view the Disruptive Strategist newsletter in full.

The rapid penetration of electric vehicles (EVs) across the globe has been mind-blowing to even the most conservative automotive producers. Not only have consumers embraced the evolution on account of lower fuel costs and an improved experience, EVs have also been promoted by policy makers to reduce emissions and fuel dependence; the European Union has aimed to end sales of new CO2 emitting cars by 2035, while the US administration set a goal to electrify all new light-duty and federal acquired vehicles by 2027/2035.

China has emerged as a global leader both in the manufacturing and consumption of EVs. Not only did China produce 35% of exported electric cars globally in 2022, but China’s domestic market also accounted for 62% of global EV sales in 2022. With EVs taking up circa 30% of all new auto sales in H1 2023, China has delivered its 2025 EV target in advance and is leading the world in terms of EV penetration.

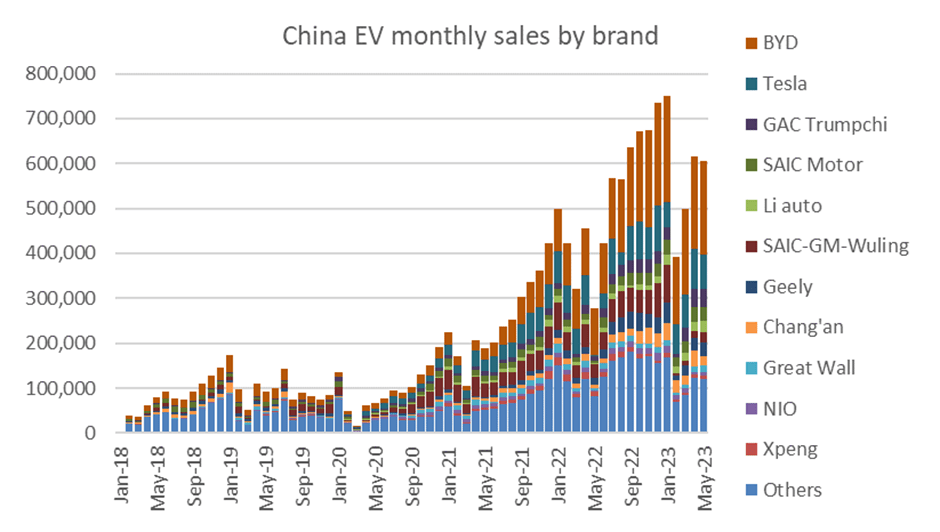

Yet unlike China’s auto adoption process 30 years ago, which was dominated by imported brands, domestic carmakers are stealing the show. EV sales in China have expanded 10x over the past five years and among bestselling EV brands in China, of the Western carmakers, only Tesla made it into the top ranks. Moreover, the volume gap between domestic and international brands is expanding with local carmakers taking even more market share across time (see chart below).

Chart 1: Monthly sales volume of electronic vehicles in China by brands

- Beyond hardware: brainy is the new sexy

While having superior hardware and legacy design capacity, many traditional original equipment manufacturers (OEMs) have been lagging in the EV transition. While most carmakers have moved past any initial reluctance and tried to catch up in recent years, the EV arena has already been flooded with new entrants. To differentiate from multiple competitors, OEMs have been searching for new technological barriers in the EV era, as hardware (especially engines) that defined winners in the era of internal combustion engines are no longer a key differentiator in the EV era.

In the eighth movie of the Fast & Furious franchise, the wild scene of thousands of hacked cars raining down from carparks was clearly haunting, though it did showcase how smart autos are becoming akin to cloud-connected robots on wheels. Nowadays, a competitive EV does not only require high-end electrical architecture, but also the latest software built upon hundreds of millions of miles of driving data, as well as regular over-the-air (OTA) software updates that keep refreshing user experience.

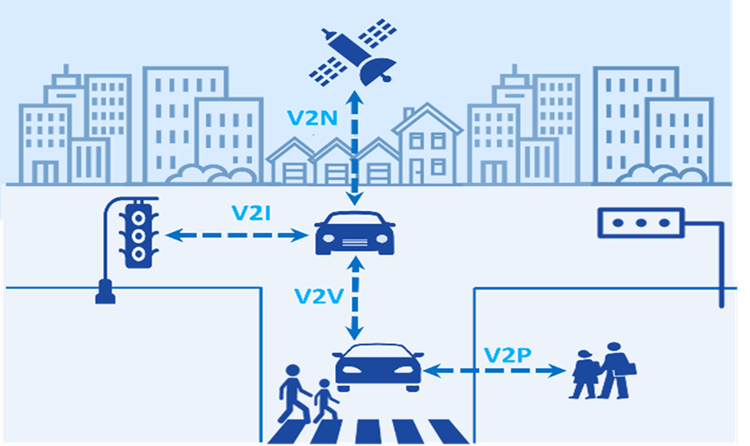

User experience has been a winning point for the new entrants of China EV OEMs. High level autopilot has become more of a standard facility rather than an add-on service; interlinked multi-screen and interactive cameras are also becoming common accessories for new models. As the auto IoT (internet of things) technology proliferates and urban traffic management upgrades, V2X (vehicle-to-everything), which allows coordination and data exchange between vehicles and other vehicles/pedestrians/infrastructure/networks, is also becoming more tangible. This could massively reduce the risk of traffic accidents and enhance autopilot to the next level (Indicated in chart below).

Chart 2: How V2X technology can transform driving safety and efficiency

Resolving range anxiety: recharge or auxiliary

In the past decade, EV battery life has notably extended from less than 100km to 500-600km for one charge. However, the age-old problem of range anxiety still hovers above further adoption of electric vehicles, especially when it comes to long-distant trips out of urban areas where charging stations become scarce.

As of 2022, China has increased the number of charging poles by 100% year-on-year to reach nearly 5 million, yet even that volume seems insufficient with 13 million EVs in the country. Apart from waiting for developments on charging infrastructure and battery technologies (such as sodium-ion batteries), EV OEMs have also come up with their own solutions to deal with consumer demand.

- Battery swap: due to the relative scarcity of high-voltage fast-charging facilities, the charging convenience for EVs is still far from that of replenishing fuel for internal combustion engines (ICEs). While Tesla has been laying out groundwork on superchargers, other carmakers like Nio are trying other measures to smooth the charging experience, such as spreading out fully-automatic battery swapping stations that take circa three minutes to swap a fully charged battery.

- Extended-range EV (EREV): another method to solve the age-old range anxiety is to utilise EREV technology, which is fully run by an electric motor but equipped with a generator on board to recharge the battery when it is depleted. Not only can it utilise fuel facilities in times of need, the EREV battery is also smaller in size and more stable in extreme weather. Both Chinese auto makers BYD and Li Auto, are growing their focus on EREVs. In our view, the significantly longer range between charges adds to their relative appeal for many buyers as the rollout of charging point infrastructure remains behind schedule and has so far been concentrated in and around higher tier cities.

Overseas expansion: quality and affordability in play

While China has experienced notable hurdles over the years in taking market share from incumbent ICE carmakers, the upscaling EV adoption has shed new light on a Chinese auto brand export story. As the world moves towards a new phase of climate change urgency, the demand for mass market affordable EVs is rising across the globe, giving made-in-China EVs another leg of growth for global expansion. During Q1 2023, China surpassed Japan to become the largest automobile exporter globally, thanks to the ramp-up of the EV revolution and global adoption.

Thanks to its superior affordability and variety, China-made EVs have been a perfect fit for a mass market EV adoption in emerging markets. As the sales volume continue to climb, scale benefits will likely further widen the cost advantage. Meanwhile, thanks to a mature EV supply chain and the premiumisation effort in their domestic market, the interior design and reliability of made-in-China EVs have also advanced to the top rank, making developed markets the next frontier for the export of Chinese EVs. Morgan Stanley expects China-made EVs to account for 30% of the global EV market share, indicating 38% annual offshore sales growth through to 2030.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio nor represent any recommendations by the portfolio managers nor a guarantee that objectives will be realized.

This material contains forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.