Markets and commentators are excessively pessimistic on the US economy. But the economy has avoided recession and shrugged off high interest rates - this has implications for US stocks and the Federal Reserve’s policy pathway.

02 October 2024

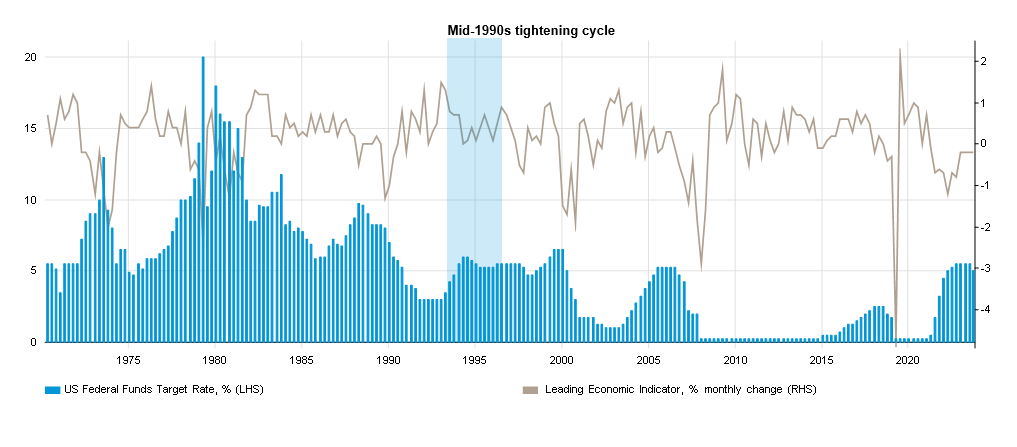

It wasn’t supposed to be like this. When interest rates are tightened, the economy should slow down and a recession often follows as consumers retrench, debts remain unserviced and corporations cannot borrow to invest in growth-generating projects. Classic examples included US monetary policy tightening in response to high oil prices in the late 1970s which prompted the early 1980s recession. Then in the late 1980s rates were again jacked up across the advanced economies which, along with the first Gulf War, led to the early 1990s recession. These are known as ‘hard landings’, in which the effort to vanquish inflation results in collateral damage to the economy. The last few decades have arguably seen a soft landing pulled off just once, when the US Federal Reserve (Fed) raised rates in the mid-1990s to 6% (0.5% higher than where they are today) and the economy emerged largely unscathed. That was exceptional though. Today there is no shortage of market indicators and commentators forecasting the classic hard landing outcome.

Pessimism may get all the attention these days but there is plenty of persuasive evidence to suggest that such a deterministic fate might be avoided this time. This matters because a soft landing, should it happen, would be welcome on two fronts. First, it would likely stabilise an increasingly jittery stockmarket and second, it might take the pressure off the Fed from embarking on an overly accommodative rate-cutting cycle which could in theory re-trigger inflation.

(Not many) Happy landings - Last ‘soft landing’ in recent times was in the mid-1990s:

Chart 1: US Fed Fund Target Rate and monthly change of leading economic indicator (from 31 March 1971 to 23 September 2024)

Past performance is not an indicator of future performance and current or future trends.

Any suggestion of an economic slowdown in the US of course needs to be taken seriously. No less than the respected Organisation for Economic Cooperation and Development’s (OECD) latest GDP forecast suggests that the US economy will slow from an anticipated 2.6% growth this year to 1.8% in 2025, supposedly dragged down by tight financial conditions and other factors such as the war in Ukraine and the conflict in the Middle East. Similarly, the much-respected US Treasury market (which Clinton campaign chief James Carville once famously said he would like to be reincarnated as) appears to be pricing in a sharp slowdown. The 10-year US Treasury bond real interest rates, which reflect the long-term economic growth forecast within the bond yield, have shown a decline from 2.3% at the end of April to just 1.6% as at 23 September.

The central case for slowdown itself appears to rest on the idea of a cooling labour market which in turn is seen as denting US consumer confidence. It’s true that the US unemployment rate has ticked up to 4.2% from its five-year low of 3.4% in January 2023. But monthly job additions as measured by the Bureau of Labor Statistics’ all-important non-farm payrolls report have been fairly robust, with no less than 142,000 jobs added in July and wages growing at a decent 3.8% rate. US job openings meanwhile continue to grow at a near-5% clip while the labour force participation rate has been steadily climbing since the pandemic low of 60% to nearly 63% in the August reading. Taken together, these suggest a growing labour market which is pulling in new workers. As those new workers declare their availability, there is inevitably a brief period while they wait to secure actual employment, which goes a long way to explaining that slightly higher unemployment rate. The attendant consumer slowdown may also have been overblown. The University of Michigan Consumer Sentiment Index may be off its elevated January 2024 level of 79 but this September’s reported figure of 69 is certainly still high by 2023 standards and very high by 2022 standards, when it plummeted to 50 in June that year soon after the Russian attack on Ukraine. Add to that the fact that retail sales are growing at a solid-enough 2.1% on the previous year, with August’s figure in particular revealing a surge in online ordering.

The case against a hard landing, and especially a recession, on the current evidence therefore seems very strong, and is all the more surprising given that the Fed funds rate has been held at an elevated 5% to 5.5% for over a year until the 50 basis points (bps) rate cut on 18 September. To finally slay the deterministic dragon, it is worth giving some thought not so much to whether the economy has escaped the effect of high rates – the evidence points to the fact that it has done so - but why it has. Keynesian-style counter-cyclical demand management may well have played a role here, with advanced economy policymakers including the US distributing huge stimulus packages to support growth during and after the Covid-19 pandemic. While admittedly coming down now, US personal savings as a % of disposable income were a fairly healthy 5.1% in June 2023, just as the Fed raised rates for the last time in the current cycle, so US consumers were already in a good place to cope with higher rates.

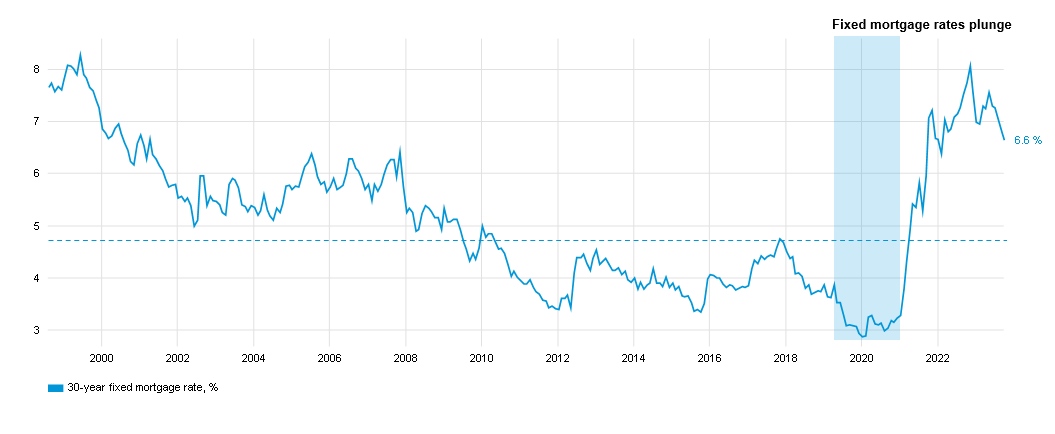

Many consumers also took out fixed-rate mortgage loans back in 2020 to 2021 when 30-year fixed rates hit two-decade lows of circa 3%. This allowed homeowners to go on to benefit from the positive aspect of higher rates in their savings accounts when rates were later tightened without the corresponding pain of paying more to service their mortgages. Furthermore, consumers have proven savvy about finding the best rates for their cash, even if that meant abandoning the traditional banks. According to the Investment Company Institute, assets in US money market funds hit an all-time high of USD 6.3 trillion in early September 2024. Finally, high interest rates may not have had the same efficacy in slowing the economy as before due to its evolving fundamental structure. Those economic sectors most demanding of borrowed capital, such as heavy industry, have waned over time amid offshoring and lower labour intensity, leaving behind a far ‘lighter’ economic landscape that is less exposed to the intended effects of tighter monetary policy.

Fix now, enjoy for years - 2020-21 set up mortgage holders well for higher rates:

Chart 2: 30-year fixed mortgage rate (From 30 July 1999 to 20 September 2024)

Past performance is not an indicator of future performance and current or future trends.

This benign picture of an unfazed US economy powering through into 2025 and beyond is not without its potential risks. Fiscal largesse has left the US heavily indebted, with the budget deficit accounting for fully -5.6% of GDP and little sign that either political party in the US plans to do much about it. This means that as consumers run down their savings, there will be no fiscal room for the government to replenish them again. This leaves good old-fashioned individual thrift, something Americans have become increasingly averse to over the recent decades. On interest rates, monetary policy easing is traditionally welcomed and further rate cuts would likely help small and mid-sized US businesses which can’t tap capital markets for cheap financing. But the Fed’s sizeable 50 bps easing of rates on 18 September hints at an aggressive and profound rate cutting cycle, which could over-boost an economy that is doing fairly well already. This could potentially create a fresh inflation problem not long after the previous one has nearly been dealt with. For now, though, investors should take solace in the fact that the economy – and related corporate earnings – are in good shape. If they can withstand interest rates at 5.5% to the bewilderment of investors and financial commentators, then that is probably something to celebrate, even if it does leave lingering questions about what monetary policy is actually for.

Julian Howard is Chief Multi Asset Investment Strategist at GAM Investments

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Investors could lose some or all of their investments.

The University of Michigan Consumer Sentiment Index is a monthly survey of consumer confidence levels in the US with regards to the economy, personal finances, business conditions, and buying conditions, conducted by the University of Michigan. It takes into account people's feelings toward their current financial health, the health of the economy in the short term, and the prospects for longer-term economic growth, and is widely considered to be a useful economic indicator.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in indices which do not reflect the deduction of the investment manager’s fees or other trading expenses. Such indices are provided for illustrative purposes only. Indices are unmanaged and do not incur management fees, transaction costs or other expenses associated with an investment strategy. Therefore, comparisons to indices have limitations. There can be no assurance that a portfolio will match or outperform any particular index or benchmark.

This article contains forward-looking statements relating to the objectives, opportunities, and the future performance of the equity markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

This disclosure shall in no way constitute a waiver or limitation of any rights a person may have under such laws and/or regulations.

In the United Kingdom, this material has been issued and approved by GAM London Ltd, 8 Finsbury Circus, London EC2M 7GB, authorised and regulated by the Financial Conduct Authority.