Christian Munafo, Chief Investment Officer at Liberty Street Advisors, explores how private companies are responding to market volatility and why this might attract investor interest.

07 May 2025

Many investors have legitimate concerns regarding potential impacts of both recent tariff announcements made by the US and initial responses from other countries. While we cannot be certain of the ultimate outcomes, we continue to believe that private markets can provide investors with numerous benefits including volatility reduction, diversification, enhanced return potential and access to opportunities that have been historically unavailable in public markets. We think this particularly holds true with strategies like ours that focus on investment opportunities in late-stage, high-growth private technology companies that drive innovation and disruption across the economy in sectors such as aerospace/space economy, cybersecurity, artificial intelligence (AI)/machine learning (ML), big-data/cloud, advanced manufacturing, fintech/digital assets, digital health, ecommerce and agricultural technology.

We are closely monitoring how current market dynamics evolve and believe there could be some near-term disruptions to capital formation and exit activity due to increased volatility and macro-uncertainty, but we anticipate a resurgence of activity and improving sentiment in the second half of 2025. In parallel, we believe there will continue to be attractive investment opportunities in high performing companies due to these dislocations which could potentially generate outperformance in the future, but investors must be disciplined and highly selective.

Capital formation

The National Venture Capital Association (NVCA) reported approximately 3,003 US Venture Capital (VC)-backed deals closed in the first quarter of 2025, with an aggregate deal value of USD 91.5 billion. This represents an 11% increase in the number of deals and an 18% increase in deal value compared to the first quarter 2024. Larger deals represented a greater share of activity with 10 transactions exceeding USD 500 million, accounting for over 61% of total VC investments. Excluding OpenAI’s USD 40 billion capital raise that closed in March, the other nine deals represent 27% of the total.

According to various sources, VC dry powder now sits at roughly USD 290 billion, but there remains a significant supply/demand ratio imbalance as more companies seek capital and shareholders seek liquidity, while investors exhibit greater discipline. As a result, this creates greater negotiating leverage for active investors willing to commit capital in both secondary transactions and new financing rounds. That said, high-performing companies demonstrating strong operating metrics will continue to be rewarded with more attractive valuations.

While current macro-uncertainly may impact the velocity of new company financings in the near term, we think it is important to be reminded that these are often attractive periods for capital deployment as investors gain negotiating leverage due to various macro and micro dislocations.

The stars are aligning for deals

We are looking at one of the largest and most compelling initial public offering (IPO) backlogs in recent history, with many high-performing technology and innovation companies generating a healthy balance of strong growth rates and profitability. For example, in January 2025, space and defence solutions company Voyager Technologies filed its confidential paperwork for an IPO, while Meta signed on as an investor to data analytics software leader Databricks as it reportedly inches towards its widely anticipated IPO. In addition, AI chipmaker Cerebras announced Committee on Foreign Investment in the United States (CFIUS) clearance in March 2025, a key step toward its planned IPO. In April, the gaming-focused social messaging service Discord announced the hiring of former Activision Blizzard Vice Chairman as its new CEO in advance of its expected IPO. Despite the challenging environment, AI cloud computing firm CoreWeave went public in March, largely driven by increasing demand for compute and inference capabilities required by large language models (LLMs), marking the largest tech IPO in years. Although Coreweave’s IPO priced at the low end of the predicted range, the stock initially surged and has held on fairly well despite subsequent tariff related headwinds.

Additionally, we are seeing increased merger and acquisition (M&A) activity involving VC-backed companies. According to Pitchbook, exit activity for the first quarter of 2025 reached the highest quarterly levels since Q4 2021, generating USD 52.6 billion across 385 deals. While we continue monitoring tariff developments and potential implications, we believe increases in corporate M&A activity and private equity (PE)-led buyouts can continue throughout 2025. In March 2025, Google announced an agreement to acquire cloud security company Wiz for USD 32 billion, marking Google’s largest ever acquisition. Also in March, Elon Musk’s AI company, xAI, acquired X (formerly known as Twitter) in an all-stock transaction valued at UAD 33 billion (net of debt).

Although tariff-related uncertainty may temporarily delay new listings and M&A activity in the near-term, we expect to see a pickup in both public market offerings and deal activity over the coming quarters as volatility subsides and headwinds calm.

Valuation trends

While public company valuations have recently pulled back due to the aforementioned macro-headwinds, we continue to observe a significant gap when comparing the valuations of our private companies with their public market equivalents. Public market comparables are just one of many inputs in our valuation framework for private companies. For instance, movements in public cybersecurity companies can affect our private cybersecurity valuations. Similarly, exit comparables, such as Google's acquisition of Wiz also serve as new valuation inputs. Other factors include private rounds of financing, secondary transactions and employee stock option issuance.

Despite the resilient operating performance of most of our companies with record levels of revenue and profitability exhibited across the current portfolio, many are still valued below their last round of financing due to various depressed valuation inputs referenced above. We believe this represents significant embedded value potential for harvesting as market conditions and underlying valuation inputs improve.

Measuring potential tariff-related impacts

Since the inception of our strategy over a decade ago, the overwhelming majority of our holdings have involved US-domiciled companies where the underlying technology, operations and revenue primarily (if not exclusively) reside in the US.

While several of our holdings have asset-heavy business models including those in aerospace/space economy, most involve asset-lite business models with very little (if any) debt on their balance sheets. By default, these companies are typically not engaged in the traditional importing and exporting of hard assets.

Although we believe the capital structures and business models of many of our holdings provide a layer of protection from the newly proposed tariffs, there will likely be some degree of both direct and indirect impacts at a macro and micro level. For example, an extended period of increased volatility and uncertainty may hit growth rates as customers pull back on consumption and spend. Furthermore, companies with less flexible supply chains may face cost increases that cannot be fully passed on to their customers, which would hurt margins and profitability.

In addition, potential disruptions to capital formation and exit activity will likely force companies to manage their balance sheets and expenditures more efficiently while further delaying realisations for shareholders and investors. Related to this, US companies may see less demand from foreign investors as the demand for dollar-denominated assets could decline.

Exposure to US government contracts

The vast majority of our underlying portfolio companies involve the private/commercial sector rather than the public sector, and this is a key consideration during our due diligence process. That said, certain sectors, like aerospace/space economy, may have a higher percentage of government contracts compared to others, such as cybersecurity.

Take Palantir, for example, a prior investment of ours. When Palantir was going public, a significant portion of its revenue was tied to government contracts, which raised some concerns for underwriters and public market investors despite the strength and differentiation of its product offerings. However, as Palantir has scaled as a public company and further developed its business model, much of that government exposure has shifted to more commercial revenue.

Ultimately, it comes down to the business model. If a company is heavily dependent on subsidisation or inefficient with its spending, it faces bigger issues. We aim to avoid investing in such companies.

By focusing more on commercial sectors and carefully evaluating a company’s operating model and revenue streams, we try to mitigate exposure to business outcomes that are less predictable.

AI: The rise of DeepSeek

A major development this year was the introduction of the DeepSeek model from China, which received significant global attention with initial data indicating far greater efficiency compared to major LLMs. While the initial data is impressive, it is important to note that DeepSeek’s R1 model was trained by leading LLMs and offers narrower, distilled modelling capabilities. What may not be widely known is that DeepSeek leveraged Cerebras’ technology to achieve processing speeds 57 times faster than the most advanced graphics processing units (GPUs) currently available with greater energy efficiency. We believe these efficiencies will accelerate AI adoption across sectors.

This development shows that AI does not always require expensive, comprehensive models. Distilled versions can accomplish specific tasks effectively. While we believe differentiated LLMs like xAI are well positioned to continue benefiting from the often referred to Fourth Industrial Revolution or Industry 4.0, this shift allows us to move from AI enablement to companies facilitating and more broadly adopting AI, which should also bode well for companies such as Databricks for increased data warehousing and analytics, Nanotronics for defect-free chip manufacturing with AI driven inspection and process control, and Cerebras for more powerful and energy efficient computing solutions.

We already see a progression from companies enabling AI to those adopting it at more attractive price points. This shift is likely to foster sustainable business models around AI adoption. However, we advocate patience and discipline when it comes to investing in this area as certain aspects remain nascent and vulnerable to disruption. We continue to believe in the tremendous demand for AI compute, datacentres/infrastructure, and energy solutions, and are exploring these areas with great interest.

Broadening accessibility to private markets

More asset managers are launching strategies like ours that broaden investor accessibility, something that we have been strongly advocating and offering for the past decade. We believe this is largely driven by a combination of increased demand from non-institutional channels seeking better diversification and an interesting dynamic in which institutional investors are increasingly overexposed to illiquid assets due to a lack of exit/distribution activity. The former provides an exciting opportunity to engage with retail and wholesale investors that have historically been unable to access these types of strategies, while the latter creates an attractive investment opportunity for groups like us to purchase securities in high performing assets from fatigued investors and shareholders often at dislocated prices.

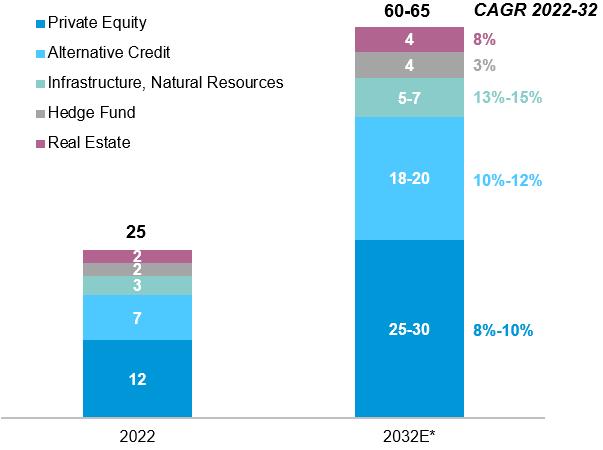

Setting the current macroeconomic environment aside, significant global growth across various alternative asset categories is expected for the foreseeable future (with PE accounting for lion’s share) as both institutional and non-institutional investors continue seeking strategies outside of traditional public equity and fixed income.

Chart 1: Global alternative assets under management (AUM), USD trillions

While recent tariff announcements are certainly raising new questions, challenges and concerns for the broader economy and both public and private market investors alike, we think it is important to be reminded that these are often attractive periods for capital deployment as investors gain negotiating leverage due to various macro and micro dislocations. As long-term investors focused on private innovation companies that improve efficiency, productivity and ultimately profitability for end customers across many sectors of the economy, we continue to believe that our underlying portfolio is well-positioned to benefit as capital formation, valuation and exit activity improve.

Everything we mentioned requires a lot of education, and that is what we are also aiming to do - educate the market.

Christian Munafo, Chief Investment Officer, Liberty Street Advisors, Inc., manages the Private Shares strategy for GAM Investments.

You can find out more about Liberty Street Advisors, private markets and late-stage venture capital opportunities here.

[DISCLOSURE: Certain companies mentioned are current or former investment positions. Current holdings include Voyager Technologies, xAI, Cerebras, Databricks, Nanotronics; former holding includes Palantir.]

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Investors could lose some or all of their investments.

This article contains forward-looking statements relating to the objectives, opportunities, and the future performance of the equity markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.

This disclosure shall in no way constitute a waiver or limitation of any rights a person may have under such laws and/or regulations.

In the United Kingdom, this material has been issued and approved by GAM London Ltd, 8 Finsbury Circus, London EC2M 7GB, authorised and regulated by the Financial Conduct Authority.