In the dynamic realm of real estate, the tale of housing demand unfolds a narrative shaped by generational shifts and economic forces. Tom Mansley, Investment Director and specialist in mortgage and asset backed securities (MBS and ABS), guides you through the chapters.

04 April 2024

In the ever-evolving landscape of real estate, several key events have shaped the housing market over the past few decades. From the 2005 peak to the tumultuous financial crisis, we have witnessed dramatic shifts. Now, enter the Millennials—a generation eager to stake their claim in the property market. What lies ahead?

The shortage of new housing

The US faces a shortage of new housing. Over the last 25 years, there has been an average of 2.2 million home sales inventory in the US. Today, however, that number stands at just 1.1 million, half of the historical average.1

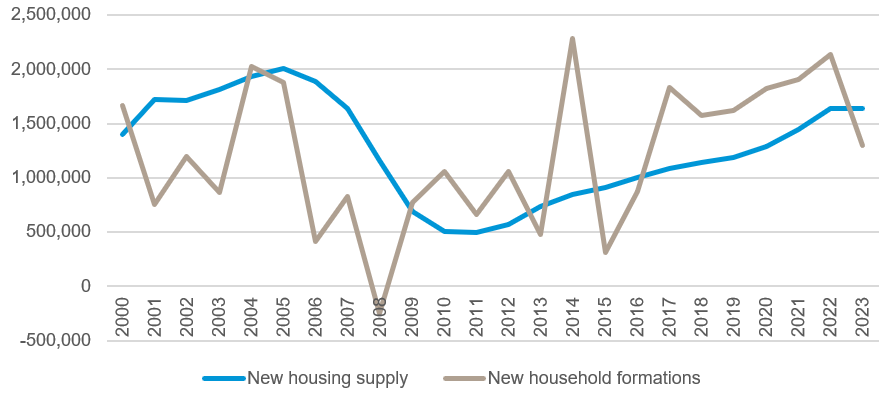

Chart 1: Year over year changes in new housing supply and new household formations

At the heart of the housing market lies the interplay between supply and demand. In the chart above, the brown line represents the number of new households forming each year which is demand for housing. The blue line refers to the annual growth of new housing units, which is the supply of housing. Prior to 2009, the housing market had more new supply than new demand. We were overbuilding during that period. However, since 2009, the situation has shifted dramatically with demand in excess of supply for many years.

The staggering shortfall of new housing units underscores the severity of the lack of housing available. But why did we fall behind in constructing enough homes? The answer lies partly with the Millennial generation. Millennials have delayed household formation, getting married and having children. These milestones have been pushed further out, but what did they do when they finally did form the household? They chose to rent, rather than buy.

The Millennial shift: From renting to buying

Around 2006, a significant shift occurred in the housing market. Millennials, characterised by their preference for experiences over material possessions, began to redefine the concept of housing.

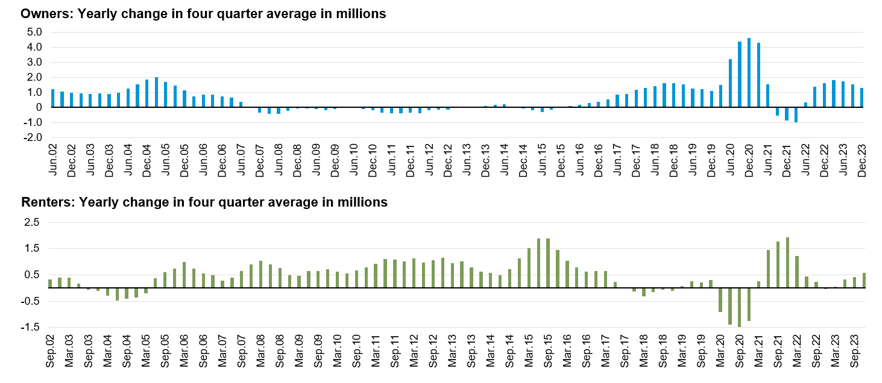

Chart 2: Household formation in the US – Owners versus renters

The blue line in Chart 2 above is new households buying homes. Traditionally, getting married, having kids and buying a house were closely intertwined milestones. However, Millennials challenged this norm. In around 2006, they came into the housing market and broke from the traditional norm. They questioned the conventional path and opted for a different lifestyle, one that prioritised mobility, experiences and urban living. For a decade since 2006, more Millennials chose to rent rather than buy.

After a decade of renting, the tide shifted in 2016. They started to buy. Why did Millennials start buying houses? Because they finally settled down, formed families and had children, their housing needs changed and they started buying houses.

The pandemic accelerator

It was not a Covid phenomenon as that trend was happening before Covid, but Covid accelerated it. Suddenly, remote work became the norm, and cramped city apartments lacked space for home offices. Closed theatres, restaurants, and limited social activities also made city life less appealing. Many of them had already started having children as well, and since they were going to buy a house eventually, a large part of that generation decided to buy the house now as Covid accelerated.

Millennials, who had previously postponed buying homes, suddenly expressed a strong desire for homeownership. However, the surge in demand outstripped the growth in housing supply over the years, resulting in a shortfall of available homes. As new demand surged, surpassing the rate of new supply, home prices increased rapidly.

After the Federal Reserve (Fed) raised interest rates in 2022, mortgage rates surged, leading homebuyers to reconsider their affordability. The cost of purchasing the same house escalated significantly on a monthly basis. These buyers were well-positioned, earning decent wages and accumulating savings; therefore, they could afford the homes but they hoped for price corrections.

However, home prices did not experience a significant drop. This prompted Millennials to act. They realised that waiting would not make homes more affordable; therefore, it was time to seize the opportunity. Additionally, in the US, mortgage refinancing remains a viable option. If interest rates decline in the future, buyers can refinance their mortgages then, adhering to the mindset of securing the house first and potentially refinancing into a lower cost later.

What lies ahead?

The narrative of housing demand unfolds as a tale of resilience and adaptation. Millennials, once renters, now drive the real estate market. Their delayed entry into homeownership has paved the way for a surge in demand that cannot be met in the short term with new supply.

Going forward, we expect a gradual, steady increase in home prices without significant shifts up (due to affordability) or down (due to strong demand). While we may experience a slowdown in economic growth, we do not anticipate it having a substantial impact on the housing market. Even if the economy does decelerate, we would expect mortgage rates to decline, providing crucial support to both the housing market and housing prices.

The information contained herein is given for information purposes only and does not qualify as investment advice. Opinions and assessments contained herein may change and reflect the point of view of GAM in the current economic environment. No liability shall be accepted for the accuracy and completeness of the information contained herein. Past performance is no indicator of current or future trends. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice or an invitation to invest in any GAM product or strategy. Reference to a security is not a recommendation to buy or sell that security. The securities listed were selected from the universe of securities covered by the portfolio managers to assist the reader in better understanding the themes presented. The securities included are not necessarily held by any portfolio or represent any recommendations by the portfolio managers. Specific investments described herein do not represent all investment decisions made by the manager. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future. No guarantee or representation is made that investment objectives will be achieved. The value of investments may go down as well as up. Investors could lose some or all of their investments.

The foregoing views contains forward-looking statements relating to the objectives, opportunities, and the future performance of the markets generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involve a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of GAM or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made.